If you are a gun owner in Nevada, you may have heard of a gun trust. A gun trust is a legal document that allows multiple people to possess and use firearms, without each individual having to go through the process of obtaining their own individual NFA (National Firearms Act) tax stamp.

In Nevada, gun trusts are becoming increasingly popular due to the state’s strict gun laws. With a gun trust, you can legally transfer ownership of your firearms to the trust, which can then be managed by a trustee. This can be especially beneficial for those who own firearms that are regulated by the NFA, such as suppressors or fully automatic weapons.

By creating a gun trust, you can also ensure that your firearms are passed down to your heirs in a legal and safe manner. The trust can include specific instructions regarding who can use and possess the firearms, as well as how they should be stored and maintained. Overall, a gun trust can provide peace of mind for gun owners in Nevada, knowing that their firearms are being managed and protected according to their wishes.

Understanding Gun Trusts

If you are a gun owner in Nevada, you may have heard of a gun trust. A gun trust is a legal document that allows you to own and transfer firearms. It is a popular option for gun owners who want to ensure their firearms are passed down to their loved ones without any legal complications.

One of the main benefits of a gun trust is that it allows you to bypass the need for a background check when transferring firearms. This can be particularly useful if you want to transfer your firearms to a family member or friend who lives in another state.

Another benefit of a gun trust is that it can protect your firearms from being confiscated by the government. If you were to pass away and your firearms were not properly transferred, they could be subject to seizure by the government. A gun trust can help prevent this from happening.

To create a gun trust, you will need to work with an attorney who specializes in firearms law. They will help you draft the trust document and ensure that it complies with all state and federal laws. Once the trust is created, you will need to transfer your firearms into the trust.

It is important to note that a gun trust is a legal document and should be taken seriously. You should only create a gun trust if you are a responsible gun owner and understand the legal implications of owning firearms. If you have any questions about gun trusts or firearms laws in Nevada, it is recommended that you consult with an attorney.

Nevada Gun Trust Laws

If you are a gun owner in Nevada, you may be interested in setting up a gun trust. A gun trust is a legal entity that can own firearms and other assets. It can be used to manage and transfer firearms to beneficiaries, as well as to provide privacy and liability protection.

In Nevada, gun trusts are governed by state and federal laws. Here are some important things to know about Nevada gun trust laws:

- Nevada does not have specific laws regarding gun trusts. However, gun trusts are still subject to state and federal firearm laws.

- Nevada allows for the transfer of firearms without a background check between immediate family members. This includes spouses, parents, children, siblings, grandparents, grandchildren, and in-laws.

- Nevada requires a background check for all firearm transfers, including those made through a gun trust, unless the transfer is between immediate family members. This means that if you want to transfer a firearm to someone who is not an immediate family member, you will need to go through a licensed dealer and have a background check performed.

- Nevada does not require gun trusts to be registered with the state. However, if the gun trust owns a Class III firearm (such as a machine gun or silencer), it must be registered with the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF).

Overall, setting up a gun trust in Nevada can provide benefits such as privacy and liability protection. However, it is important to understand and follow state and federal firearm laws when using a gun trust.

Benefits of a Gun Trust in Nevada

If you are a gun owner in Nevada, setting up a gun trust can provide you with several benefits. Here are some of the advantages of having a gun trust in Nevada:

Asset Protection

One of the main benefits of a gun trust is asset protection. By setting up a trust, you can ensure that your firearms are protected from creditors, lawsuits, and other legal claims. This means that in the event of a lawsuit or bankruptcy, your firearms will be safe from seizure.

Privacy

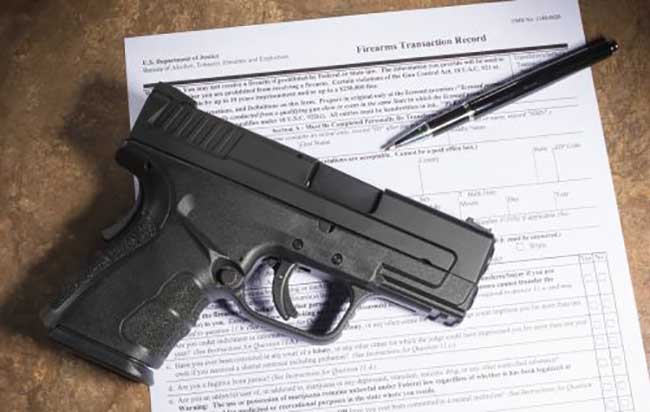

Another benefit of a gun trust is privacy. When you purchase a firearm, you are required to fill out a Form 4473, which includes personal information such as your name, address, and social security number. This information is kept on file by the federal government and can be accessed by law enforcement agencies. By setting up a gun trust, you can keep your personal information private and protect your firearms from prying eyes.

Ease of Transfer

A gun trust can also make it easier to transfer your firearms to your heirs. When you pass away, your firearms will be transferred to your beneficiaries according to the terms of your trust. This can help avoid probate and ensure that your firearms are transferred to the intended beneficiaries.

In summary, a gun trust in Nevada can provide you with asset protection, privacy, and ease of transfer. If you are a gun owner, setting up a gun trust may be a wise decision.

How to Set Up a Gun Trust in Nevada

If you’re a gun owner in Nevada, setting up a gun trust can be a smart move. It can help you avoid legal issues and ensure that your firearms are passed down to your loved ones according to your wishes. Here’s how to set up a gun trust in Nevada.

Selecting a Trustee

The first step in setting up a gun trust is selecting a trustee. This is the person who will manage the trust and its assets. You can choose anyone you trust to serve as your trustee, including yourself. However, keep in mind that if you are the only trustee and you become incapacitated or pass away, there will be no one to manage the trust. It’s a good idea to name a backup trustee in case something happens to you.

Drafting the Trust Document

Once you’ve selected a trustee, you’ll need to draft a trust document. This document outlines the terms of the trust, including who the beneficiaries are and how the assets will be distributed. You can create a gun trust yourself using online forms, but it’s recommended to consult with an attorney who has experience in gun trusts to ensure that your trust is legally sound and meets your needs.

Funding the Trust

After you’ve drafted the trust document, you’ll need to fund the trust. This means transferring ownership of your firearms to the trust. To do this, you’ll need to complete a bill of sale or other transfer document and have it notarized. You’ll also need to update your gun registration with the Bureau of Alcohol, Tobacco, Firearms, and Explosives (ATF) to reflect the trust as the owner.

In conclusion, setting up a gun trust in Nevada can be a wise decision for gun owners. By selecting a trustee, drafting a trust document, and funding the trust, you can ensure that your firearms are passed down according to your wishes and avoid legal issues. Remember to consult with an attorney to ensure that your gun trust is legally sound and meets your needs.

Common Misconceptions About Gun Trusts

When it comes to gun trusts, there are a lot of misconceptions out there. Here are a few common ones you should be aware of:

- Misconception #1: Gun trusts are only for wealthy people. This is not true. While it’s true that some people may use gun trusts as a way to pass down valuable firearms to their heirs, anyone can benefit from a gun trust. For example, if you own multiple firearms and want to make sure they are passed down to your loved ones in a way that is legal and hassle-free, a gun trust can be a good option.

- Misconception #2: Gun trusts are only for NFA firearms. While it’s true that gun trusts are often used for NFA firearms (such as machine guns, suppressors, and short-barreled rifles), they can also be used for regular firearms. In fact, a gun trust can be a good way to ensure that all of your firearms are passed down to your heirs in a way that is legal and hassle-free.

- Misconception #3: Gun trusts are unnecessary if you have a will. While it’s true that you can pass down your firearms through a will, there are some advantages to using a gun trust instead. For example, a gun trust can help you avoid probate, which can be a lengthy and expensive process. Additionally, a gun trust can help you ensure that your firearms are passed down to your heirs in a way that complies with state and federal laws.

- Misconception #4: Gun trusts are only for gun collectors. While gun collectors may benefit from using a gun trust, anyone who owns firearms can benefit from one. For example, if you own firearms for self-defense or hunting, a gun trust can help ensure that your firearms are passed down to your heirs in a way that is legal and hassle-free.

Overall, there are many misconceptions about gun trusts. By understanding the facts, you can make an informed decision about whether a gun trust is right for you.

Frequently Asked Questions About Nevada Gun Trusts

If you’re considering setting up a gun trust in Nevada, you probably have some questions about the process. Here are some frequently asked questions to help you better understand Nevada gun trusts:

What is a gun trust?

A gun trust is a legal document that allows multiple people to own and use firearms. The trust is set up to comply with federal and state laws, and it can provide several benefits to gun owners, including privacy, flexibility, and protection from liability.

Who needs a gun trust?

Anyone who owns firearms and wants to ensure that they are passed down to their heirs or beneficiaries should consider setting up a gun trust. Additionally, if you want to share your firearms with others, such as family members or friends, a gun trust can help you do so legally.

How is a gun trust different from individual ownership?

When you own firearms individually, you are the only person who can legally use or possess them. With a gun trust, multiple people can own and use the firearms, as long as they are named as beneficiaries in the trust. Additionally, a gun trust can provide protection from liability and ensure that your firearms are passed down to your heirs or beneficiaries in the event of your death.

Do I need a lawyer to set up a gun trust?

While it is possible to set up a gun trust on your own, it is highly recommended that you work with an experienced attorney who is familiar with the laws and regulations surrounding gun trusts. An attorney can help you ensure that your trust is legally sound and that it complies with both federal and state laws.

How much does it cost to set up a gun trust?

The cost of setting up a gun trust can vary depending on several factors, including the complexity of the trust and the attorney’s fees. However, most gun trusts can be set up for a few hundred dollars.

Can I add or remove beneficiaries from my gun trust?

Yes, you can add or remove beneficiaries from your gun trust at any time. It’s important to keep your trust up to date and ensure that it reflects your current wishes and intentions.

Can I use my gun trust to purchase firearms?

Yes, you can use your gun trust to purchase firearms. However, you will still need to go through the same background check and approval process as an individual would when purchasing firearms.

Can I still use my firearms if I set up a gun trust?

Yes, you can still use your firearms if you set up a gun trust. In fact, a gun trust can provide more flexibility and privacy when it comes to using and sharing your firearms with others.

Overall, a gun trust can be a valuable tool for anyone who owns firearms in Nevada. If you have more questions about gun trusts or want to set one up, it’s important to work with an experienced attorney who can guide you through the process and ensure that your trust is legally sound.